Sunday Evening Market Update: Precious Metals in Full Flight

What an extraordinary evening in the precious metals markets. As Asian trading opens this Sunday night, the screens light up with the kind of price action that forces even seasoned observers to sit up a little straighter.

Silver leads the charge.

It trades around $79, after swinging from lower levels to fresh records in recent sessions — a dramatic intraday range and substantially higher on the week. Year — to — date, silver posts gains of approximately 170 percent. For context, it closed in 2024 near $29. This does not represent a gentle drift higher; this represents a market in full flight.

Gold follows strongly.

It pushes above $4,530, with peaks near $4,550. Gold futures closed the prior week above $4,500 for the first time ever — more than double its level at the end of 2023. Descriptions of this as one of the steadiest multi — year uptrends on record carry weight.

Platinum and palladium join the advance, each posting strong daily gains. When the entire complex moves in unison, deeper forces typically operate.

Several forces converge:

- Federal Reserve actions that expand balance sheet flexibility.

- A persistently weak dollar, leaking value against commodities and certain currencies.

- Elevated geopolitical tensions across multiple regions.

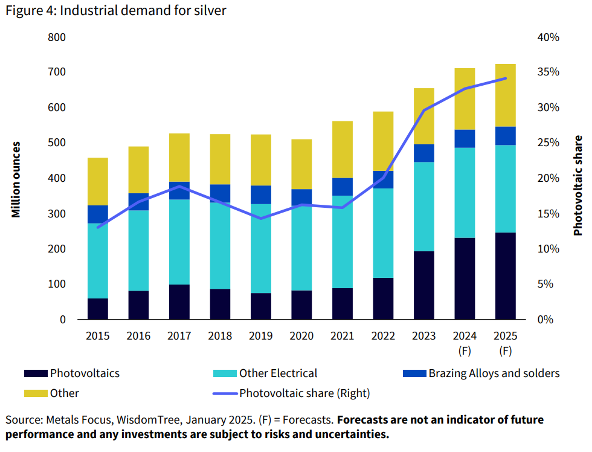

- Growing concerns about physical silver supply, amplified by export restrictions and industrial demand.

Whether one views this as a flight to safety, a hedge against currency debasement, or momentum building on itself, the tape sends an unmistakable message. Markets rarely behave this way absent underlying strain.

This offers observation only — not investment advice. Yet when precious metals move like this on a quiet Sunday evening between Christmas and New Year, it commands attention.

2025 holds a few days yet. Stay tuned.