Things are going to get very rough over the next few days and weeks (and months). This article from today's New York Post speaks to the coming sh*t storm traveling across the flyover part of America will entail.

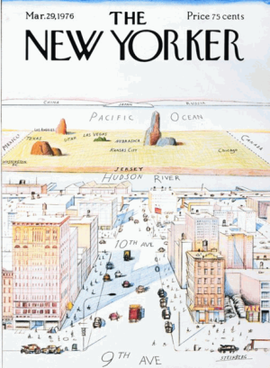

Over the horizon of the Hudson river (a reference to a famous New Yorker cartoon about a New York City resident's perspective of America from Ninth Avenue), temperatures in America's core are plunging [Due to global warming? Ha! The joke is on you deep-pocketed taxpayers.]

What this means is that the demand for energy to generate volumetric heating is soaring. There is a chance in some geographic locations, the price of energy will go parabolic, which means that one cannot buy a commodity [energy in this case] at any price. There is simply nothing more that can be purchased.

Who knows how high electricity prices are going to rise in Texa's electricity pool. New England residents are basically on their own from an energy perspective until the end of March. No more energy is crossing New York State. Some electricity may come south from Quebec Hydro hydro-electric dam generators, but NY State is going to suck up most of that electricity. And on a national basis, President Biden has drawn down the National Petroleum Reserve to historical lows, largely for political reasons to lower gas prices and "buy" Democratic and Independent votes in the recent mid-term elections, which rather interestingly are highly concentrated along American coasts and prominent rivers.

Where is our American political leadership? Most of their time, on both sides of the Congressional aisle, has been spent on the considerable problem that is the narcissistic fool named former President Donald Trump. That idiot's behavior since leaving office has proven to so many that he is unqualified ever again to be an American President. Alright, get on to the really significant problems America faces.

Over the Pacific Ocean horizon, the news out of China about the Covid outbreak is wildly understated. Last I saw they only have supposedly had two deaths from Covid. Please explain how their funeral homes are reporting on local news media of becoming so packed that the dead bodies are being stacked like firewood because the burn furnaces are running non-stop.

And overnight the Bank of Japan signaled that for the first time in like forever they are going to start raising short-term interest rates. Maybe the reader is not familiar with what this implies, but the easy money era in America is most definitely over. The dollar has reached its pike for this cycle. The dollar is going down a minimum of 20%.

Over the Atlantic Ocean horizon, the "special military operation" in Ukraine continues. War really is terrible and many people who do not serve to die are being killed. The Western democracies have had a despicable reaction. They pledge support to Ukraine but largely deliver next to nothing but empty promises. The Americans and British are spending considerable coin to support the Ukrainians. Good, but these democracies also are reluctant to take out the lunatic Russian leadership. Yes, I mean the Americans and British are probably going to have to destroy the Russian leadership, much like their special forces probably did with the Nord Stream pipelines. Meanwhile, Western Europe and its politicians are confronting a stark reality: They have virtually zero energy security or even resiliency. How do they provide energy for the 2023-24 winter?

At home, American credit card debt balances are close to all-time highs both on a notional basis and as a percentage of GDP. Take a look at what is going on with the car loans on used cars. 2023 is probably going to be a record year for defaults and repossessions.

Perhaps you missed the debacle that was cryptocurrency trading and the sociopath fraud that is Sam Brinkman-Fried ("SBF"). He is also an MIT graduate with two prominent academic parents. He made his supposed Billions by the time he was 29.

I was one of the bond vigilante traders at Lehman Brothers in the 1980s. By the time I was 29, I was the fourth highest-paid trader on their famed fixed-income trading floor. I had been the young "kid" who figured out how to "cut and dice" mortgage pools into what became known as Collateralized Mortgage Obligations ("CMOs").

I worked hard, extremely hard with crazy long hours in those years, and received more than a million dollar bonus (back when a million meant something. One 1988 dollar is now worth about 2.52 in 2022.) Why did I, Lars Toomre, turn out so differently than SBF many have been asking me in the last two months?

A short aside, despite being labeled geeks and often considered social outcasts as not even a part of the "in" social crowd, there is considerable pride in most MIT graduates [see 2019 MIT CDOIQ video]. Graduating from MIT means that you have survived the intellectual gauntlet of being confronted with near impossible-to-solve problem sets and even tougher tests. One does not go to MIT to party. One works and works. It is amazing how so many MIT graduates reply to the query "What did you learn at MIT?" with the simple true statement "I learned how to think."

Graduates with a Brass Rat school ring are quite proud that the general public acknowledges that MIT engineers got America to the moon. MIT engineers solve many tough problems. SBF is going to face special wrath for using the MIT reputation to steal so much from so many other technically savvy people.

My daughter is 29 today and working hard at Goldman Sachs. Quite a contrast to SBF as well.

What is intelligentsia (e.g., "left-wing progressive politicians, academics and media") in America talking about? Is Elon Musk booting some American media members for enhancing the distribution of publicly available data about where he and his private plane might be located? Senator Karen (Warren) is consuming considerable news attention worrying about how Elon Musk might be violating laws because he also is the head of Tesla.

Is the political class even aware of the coming wave of problems????????????? Are they aware that most pension plans are going to be down at least twenty percent for the 2022 calendar year. Some plans are going to be down more than 50% and they were not speculating. They just piled in private equity, private debt, private real estate, private venture capital and private hedge funds. The degree of concentration will be revealed when compares the horrible returns of public REITS and private REITs like those of Blackstone and Starwood, both of which are now "gated."

The rest of this WILT will be completed in coming days.